Mortgage rates posted more drops this week, lowering the borrowing costs of potential home shoppers and refinancers. Rates are now at a nine-month low, which helped boost mortgage applications more than 20 percent this week.

“Lower mortgage rates combined with continued income growth and lower energy prices are all positive indicators for consumers that should lead to a firming of home sales,” says Sam Khater, Freddie Mac’s chief economist.

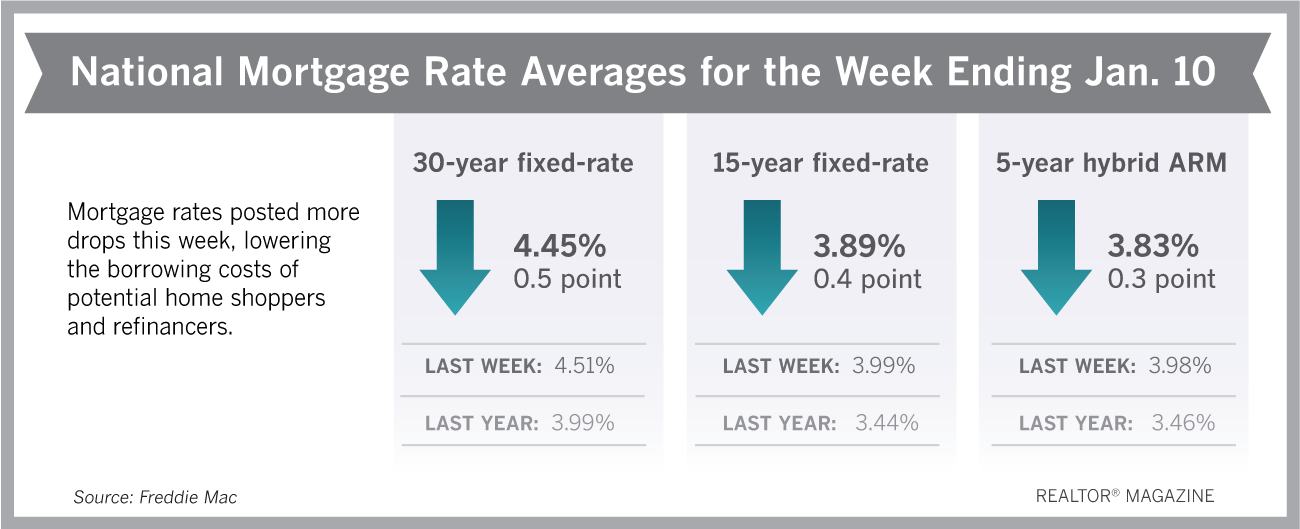

Freddie Mac reports the following national averages with mortgage rates for the week ending Jan. 10:

- 30-year fixed-rate mortgages: averaged 4.45 percent, with an average 0.5 point, falling from last week’s 4.51 percent average. Last year at this time, 30-year rates averaged 3.99 percent.

- 15-year fixed-rate mortgages: averaged 3.89 percent, with an average 0.4 point, dropping from last week’s 3.99 percent average. A year ago, 15-year rates averaged 3.44 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.83 percent, with an average 0.3 point, dropping from last week’s 3.98 percent average. A year ago, 5-year ARMs averaged 3.46 percent.